What Is a Hard Money Loan?

Hard money loans are short-term loans that real estate investors use to acquire properties quickly and access capital. Investors often use hard money to secure a loan for a property that a bank or institutional lender would usually avoid lending on, like a fix and flip property or distressed property. However, Many times investors use hard money to close on an investment property quickly, regardless of the condition.

Rates for hard money can vary significantly from lender to lender and from state to state. However, at Capital Fund 1, rates start as low as 7.99%*, and terms range from 6–24 months. If you are active in investment real estate, you might be familiar with how these products work. For those newer to the real estate investing game, the only thing that hard money lenders look at is the asset value. For us, that means we don’t require a credit check, appraisal, or personal financials.

What Happens If You Default on a Hard Money Loan?

Defaulting on any loan is a financially stressful situation that should be avoided at all costs. But, since humans are obsessed with hypotheticals, let’s dive deep into the process.

In short, defaulting on a hard money loan will inevitably lead to the foreclosure process that ends with either the bank taking possession of the property or putting it up for sale at auction.

Many real estate investors know there are pages and pages of regulations and rules surrounding the foreclosure process for a traditional mortgage like an FHA or conventional loan on an owner-occupied home. In the hard money or asset-based world, the details of what is considered “default” status are lined out in the loan documents signed at closing. Traditionally, the default status is achieved by either a breach of contract or non-payment.

So, if I go into default, the property immediately goes into foreclosure?

No, not so fast! The loan documents also outline how a borrower can remedy a default status and bring their loan current. Remedies include catching up on missed payments and any applicable fees. For example, if a payment is missed, common provisions include having up to 30 days to catch up before a property enters a state of default.

Once the property does cross the threshold into default, other provisions outlined in the loan documents kick in, like a default rate and additional monetary penalties. In this example, let’s assume the loan documents lay out a default rate of 29% and a late fee of 10% of the monthly payment. This means your monthly payments increase until the default status is remedied or the borrower finds alternative financing to pay off the current lender.

Now, let’s say the borrower cannot make any payments, and the lender must now move into the foreclosure process. Depending on the local regulations and how the property was recorded, the foreclosure process may differ. An important distinction is mortgagee states vs. deed of trusts states. Mortgagee states require a lender to go through the court system to foreclose on a property. A deed of trust state does NOT require lenders to go through the court system, often called a nonjudicial foreclosure.

At Capital Fund 1, if a loan is in default for 2 consecutive months, the loan moves into foreclosure proceedings. Once the proceedings begin, the borrower has 91 days (according to Arizona law) until the property can be sold at auction. Our team remains ready to work with our borrower during this time frame and understand the unique situation. The borrower can, at any time, refinance the property with another lender or pay off the entirety of the loan to cease foreclosure proceedings. However, also during this time, any penalty rates and fees are accruing, the sum of which will be added to the amount owed or the “payoff amount”; eating away at any equity in the property.

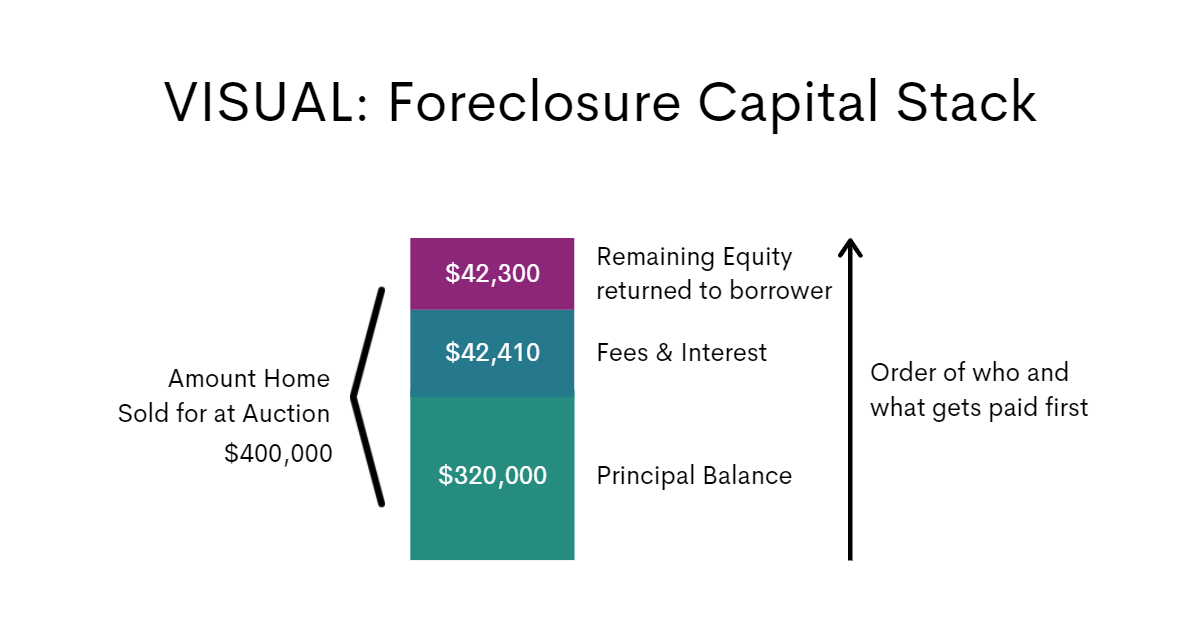

Do you Keep Your Equity in a Foreclosure?

Equity stays with the property even in the event of a foreclosure. A lender cannot keep any proceeds that are greater than the owed amount from a sale. So yes, a borrower will get any equity leftover during a foreclosure after all liens are paid. The amount of equity a borrower may get back depends on two variables:

- The payoff amount, including penalty interest and fees

- If there are multiple loans or liens on the property, they are also paid before any equity goes to the borrower.

- What the property sells for at auction.

But don’t get too excited; foreclosing is not a get out of jail free card for a number of reasons:

- The increased payoff amount is eating away at any equity in the property

- Properties at auction are typically sold at under-market value.

Let’s Do a Scenario.

Let’s do some math and outline a likely scenario with the following assumptions:

Property Purchase Price: $400K | Downpayment: $80,000 | Loan amont of: $320,000

Scenario: A real estate investor runs out of capital during the project and is unable to complete the rehab or make the monthly, interest-only payments.

Default assumptions

Default rate: 29% | Late payment fee: 10% of monthly payment | Default status: 30 Days

Foreclosure proceedings: 60 Days | Time till auction: 91 days

At an auction, the lender reports a pay off amount of $362,530

Home sells at auction $400,000

Amount left after bank payoff (equity): $48,000

Borrower’s return on investment: -$32000 + any initial closing costs and rehab done on the property.

How many Loans Do We Foreclose On?

Capital Fund 1 is not in the business of foreclosing on houses. In fact, it is illegal for any lender to lend on a property for the sole purpose of foreclosing on it. When we are funding loans, it is always our aim to work with the borrower and make sure that we can both get what we need out of the deal. It is only after multiple emails and calls that we would need to start this process and must take back a property. We want to make sure they can make their payments or work out an extension so that we do not have to foreclose on the property. Since we opened in 2009, we have only had to foreclose on 58 properties out of nearly 7000 loans and $1.7 Billion funded. It is important to understand that, because we do not underwrite the borrowers personal financials, and our loans are not reported to credit bureaus, the foreclosure of collateral is the ONLY recourse a hard money lender has.

I appreciate the tips about hard money lending. The idea of getting a money loan is appealing to me. I’ll be sure to find the right lender.