New Loan Product

More Options. More Freedom.

Introducing Our Long Term Rental Program

We’re empowering real estate investors with more options to maneuver their real estate business. With CF1’s long term rental program, you have the flexibility to turn your short-term flip into a long-term asset.

Ready to apply? Click here

Long Term Rental Explained

How Does this program work?

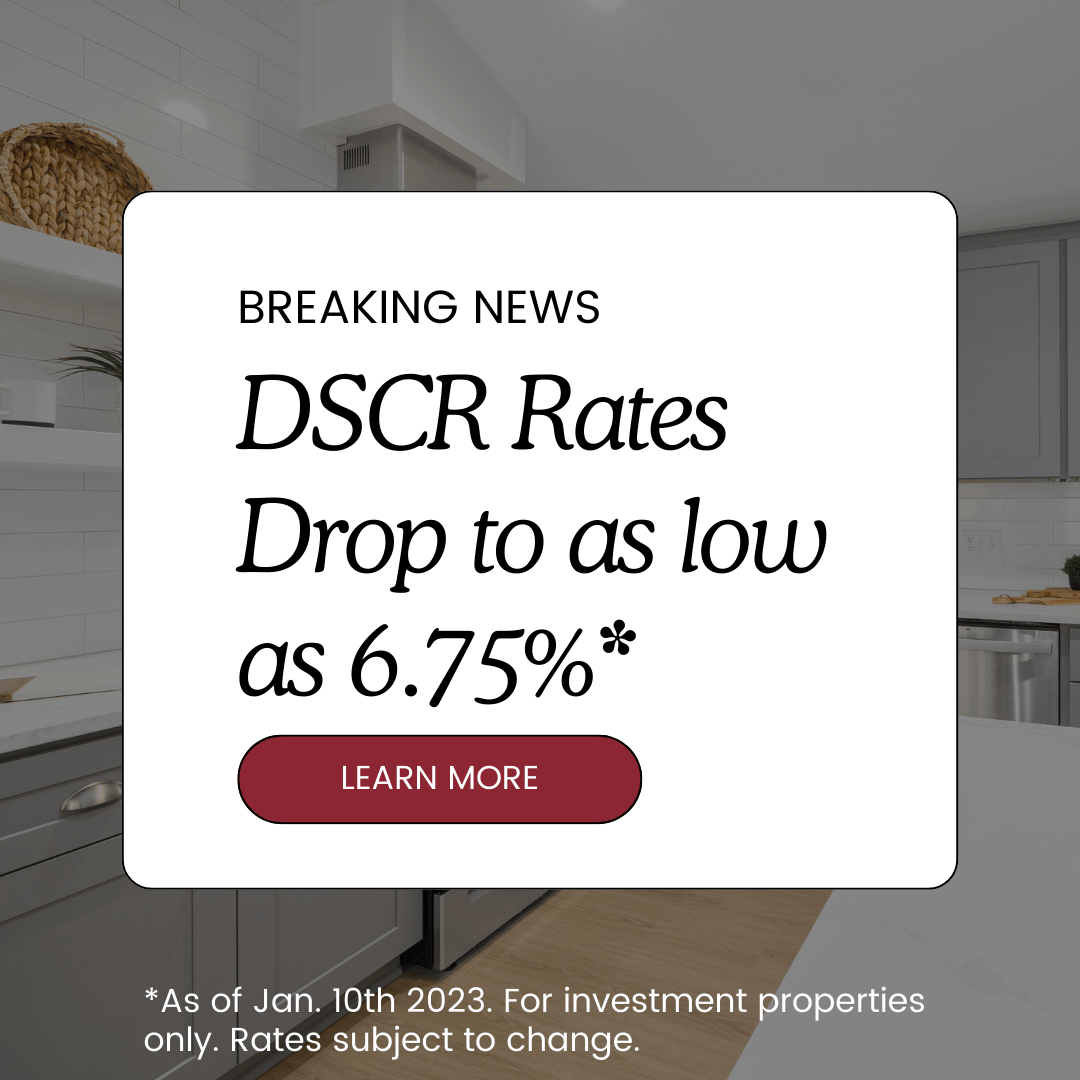

This program acts like a DSCR (Debt Service Coverage Ratio) loan. So what is a DSCR loan? DSCR Definition:

A debt service coverage ratio loan or DSCR is a long-term real estate investment loan. This is different from other real estate investment loans, in that the primary way of qualifying is how much income the property generates on a monthly basis. Typically, the income generated from the property must be at least equal to or even greater than the expected monthly payment. For example, if a single-family home in Tempe, AZ is generating a rent of $2,500 a month, you could qualify for a loan that has a monthly payment of $2,500.

Important Things to Note

Each lender will differ slightly in their specific qualifications for a DSCR loan.

A common example is some lenders will require a specific DSCR ratio on their loans.

- What is a DSCR ratio?

- A DSCR ratio is the income generated by the property divided by the expected monthly payment of the loan. Using our Tempe, AZ example. A DSCR ration requirement of 1.0 means the property has to generate at least the monthly payment, or $2,500. If the lender has a requirement of a DSCR ratio of 1.2X, then we would multiply 1.2 by the expected loan payment. In this scenario, our Tempe property would have to generate $3,000 in income to qualify for a $2,500 monthly loan payment.

Centered Around You

Why Should I Trust Capital Fund 1?

15,000 Deals Analyzed

Since opening our doors in 2009, our asset management team has analyzed over 15,000 deals across 3 states.

$2 Billion Funded

This past summer, we celebrated funding $2B in loans. With an avg. loan amount of $350k, this represents thousands of projects.

5,000 Individual Borrowers

Our success is only because thousands of people have trusted us to facilitate the success of their real estate business.

Proprietary Software

Our leadership team has invested a vast amount of resources in our Investor Toolbox. A no-cost tool available to all real estate investors